Under distress because of the fall of oil income, Angola is in talks with some of its oil clients in a bid to restructure financing facilities, the Ministry of Finance has said. China is the main buyer of Angolan oil exports, and the creditor of around USD 23 billion .

In a statement issued on Tuesday, Angola´s Ministry of Finance says that, in consultation with the International Monetary Fund (IMF), it has decided to take advantage of the G20’s Debt Service Suspension Initiative (DSSI). Luanda has applied to sovereign lenders for a debt service standstill on loans from other governments.

Taking up the DSSI would allow Angola to suspend payments of principal and interest to G20 members from May 1 to the end of the year. The G20’s move was seen as trying to avoid a wave of defaults that would otherwise have been likely to occur.

The Institute of International Finance (IIF) has reported Angola has a substantial Eurobond repayment due this year, of around $750 million.

The proceeds of this should free up funds for the Angolan government to tackle coronavirus over the next few months, the Ministry adds.

Without mentioning China specifically, the statement adds that the Government “is currently in an advanced stage of negotiations with some of its oil importing partners to reschedule financing facilities to better reflect the current market environment and OPEC’s production quotas”.

The recent cuts in OPEC quotas meant Angola had to cut its production, at a time when oil income was already falling steeply. As a result of the OPEC+ agreement in April, Angola agreed to reduce its production to 1.18mn bpd for the first two months of cuts, which is due to conclude at the end of June.

OPEC is due to hold a meeting on June 9-10 and the question of whether to extend cuts is likely to be the most hotly watched aspect.

According to Tuesday´s statement, the measures implemented, in cooperation with the IMF and the multilateral partners, are expected to keep the country “on the right path to guarantee the necessary emergency aid to the country for 2020 and long term macro-financial stability”.

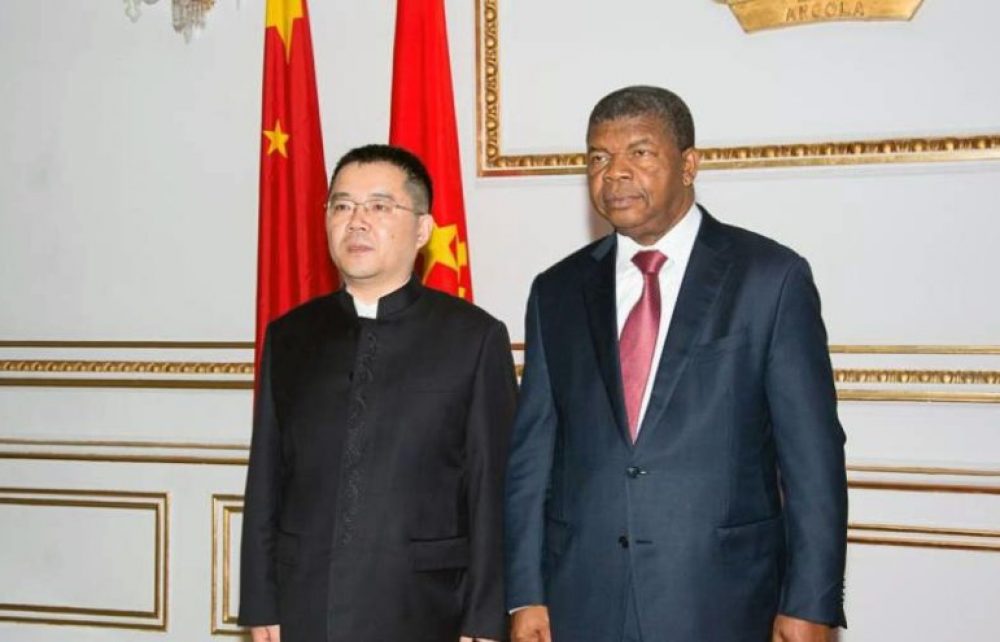

The matter of Angola´s debt to China, valued by the Government at USD 23 billion, was recently addressed by the foreign ministers of both countries. Angolan minister Tete António also called attention of his counterpart to Angola´s privatization program, according to a recent statement from the Angolan Government.

Angola had written its budget for 2020 based on a crude oil price of $55 per barrel. This was cut to $35 per barrel as the scale of the oil crash became evident earlier this year, with output of 1.36 million barrels per day.