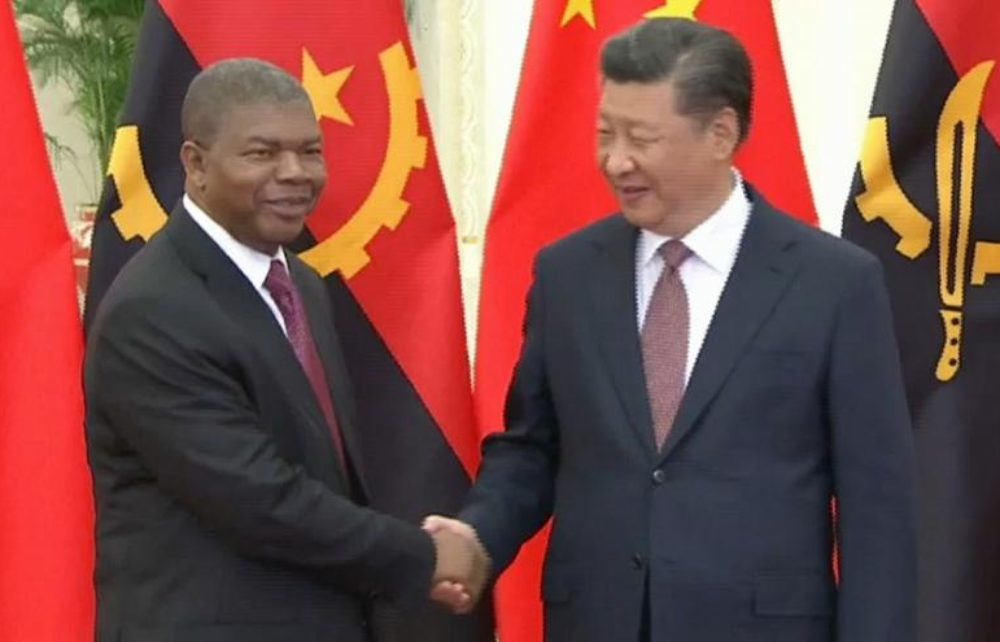

Angolan President João Lourenço is diversifying the country´s external partnerships “away from over dependence on China”, which is its main creditor, according to a new report by Chatham House.

As of December 2021, USD 13.6 billion of Angola’s recognized debt to China was owed to the China Development Bank (CDB) with USD 4 billion owed to the Export-Import Bank of China (EXIM Bank). It has also borrowed from China’s largest commercial lender, the Industrial and Commercial Bank of China (ICBC), according to the report “The response to debt distress in Africa and the role of China”.

“Debt repayment, relief and cancellation continue to be a priority for the administration of President João Lourenço during his second term, starting in September 2022 (as is diversifying Angola’s external partnerships away from an over dependence on China)”, Chatham House says.

Angola accelerates plan to repay USD18 billion debt to China

China has made over USD 42 billion in loan commitments to Angola over the last 20 years. China provided significant assistance by kick-starting over 100 projects in energy, water, health, education, telecommunications, fisheries and public works – backed mostly by oil loans.

In 2021, Angola was the most indebted country to China of any African state, and 72 per cent of all Angola’s oil exports went to China – making the country the fifth-largest exporter of oil to China. Meanwhile, China holds around 40 per cent of outstanding government external debt, worth about USD 18 billion, according to Chatham House.

“After the civil war ended in 2002, reconstruction was the Angolan government’s top priority. China’s debt exposure to Angola has accumulated dramatically over the last 20 years”, according to the report by Alex Vines, Creon Butler and Yue Jie.

The IMF has estimated that the Angolan government debt-to-GDP ratio stood at 86.4 per cent in 2021 and will stand at 56.6 per cent in 2022, having decreased from over 130 per cent in 2020 due to currency and oil price fluctuations. The Angolan government projected that debt-servicing costs will stand at USD 12.9 billion in 2022, of which 38 per cent relates to external debt.

In January 2020, the Lourenço administration signalled its wish to end all oil-backed loan arrangements and re-emphasized this point again in early 2022.19 Angola signed up to the G20’s DSSI in 2020, allowing the country to concentrate its resources on tackling the pandemic.

In 2021, the Angolan government requested G20 members to extend the DSSI from 1 July to 31 December 2021, which allowed for a total deferred payment estimated at USD 1 billion in 2020–22.

China Suspends USD 2.1 billion of Debt Service Payments from 23 Poor Countries

“Angola has actively engaged with key creditor countries on adjusting its debt financing facilities, but renegotiation of the terms of its oil-backed loan repayments to China – especially the duration of a payment moratorium – has been opaque”, the report says.

China initially wanted bilateral negotiations only but, under pressure from the West and Angola, shifted its position and lobbied for Angola to be part of the DSSI. However, it is likely that DSSI relief only applied to a minority of the debt stock to China held by EXIM Bank, with a much larger majority held by CDB and ICBC subject to bilateral negotiations, the same source adds.

Details of these negotiations have not been made public, though there are indications that Angola reached an agreement for a three-year moratorium from May 2020 until May 2023 on principal repayment instalments to the CDB and ICBC.

“Angola has also benefited from the spike in oil prices in 2022, which has assisted repayment of loans as the terms of the moratorium with Chinese lenders reportedly required repayments to resume if oil prices rose above USD 60 a barrel”, Chatham House says.

According to Finance Minister Vera Daves de Sousa, the country has paid USD 1.32 billion in repaymentsto China in 2022. De Sousa also said Angola would be careful about stepping into the market for further loans.