Mozambique’s slow burning coal revolution has triggered a wave of rail and port projects across the northern half of the country. The presence of coal reserves in Tete Province had long been known but the lack of transport capacity prevented mining in the area until relatively recently. Low coal prices over the past three years have slowed development but billions of dollars of foreign investment has still been committed to opening up new or revamped railways to the coast.

During the years of weak coal prices, it would have been understandable if all big foreign companies had suspended investment or pulled out of Tete entirely. Rio Tinto did sell its assets but Brazilian mining giant Vale stayed and continues to bank on an upturn in global coal demand. The presence of Indian firms in the country, including Essar and the International Coal Ventures Ltd consortium indicates that a large proportion of Mozambican coal will be heading to South Asia.

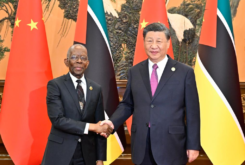

Chinese companies are coming

Chinese companies have not invested directly in mining but firms from other countries are banking on continued Chinese demand for both thermal and coking coal to sustain export volumes. In addition, China National Complete Engineering Corporation (CNCEC) is to develop the country’s third coal export railway. Finally, Mozambican officials have held preliminary talks with Chinese state organisations in the hope of gaining support for rail projects.

Such a lot has happened with rail and port projects in Mozambique over the past few years that it is easy to miss the big picture. There are two operational coal export lines and another one is planned to transport coal from the Moatize coal fields in Tete, where all current commercial coal mining is located. The Sena line from Moatize to the Port of Beira was the first to be developed. Although badly damaged in the civil war, it was at least already in place.

The railway was revamped but Vale Moçambique wanted its own dedicated line and so began work on building a 906km railway from Tete to Nacala, which is generally accepted to have the deepest natural harbour on the east coast of Africa. Vale Moçambique is owned by Vale (85%) and Japanese firm Mitsui (15%), while the two partners own equal shares in the Nacala railway.

In December, Vale Moçambique announced that it had secured US$2.73 billion in financing to further develop its railway and coal terminal, which are operated by its offshoot, Nacala Logistics Corridor (NLC). Japan Bank for International Cooperation is to lend US$1.030 billion; the African Development Bank US$300 million; a consortium of mainly Japanese banks US$1 billion; and a consortium of four South African banks the final US$400 million.

The main shareholders have tried to improve NLC’s finances by increasing the tariffs they charge themselves from US$89.30/ton to US$93.80/ton during the course of last year. The line carried 5.5 million tons in 2016 rising to 12 million tons last year and will soon have the ability to transport 18 Mtpa, with further increases possible at a later date.

Five trains a day currently transport coal from Moatize to Nacala carrying an average of 7,500 tonnes a day for shipment. As a result of higher volumes, Vale Moçambique has now recorded five consecutive profitable quarters after previously recording only losses. The split between coking and thermal coal is 60:40.

Vale decision hits Beira

Vale has now switched all of its coal exports from Beira to Nacala, freeing up capacity on the Sena line for other users but this will badly affect the Sena railway’s profitability for the foreseeable future. It is difficult to avoid the conclusion that redeveloping the line for coal exports was a mistake, particularly as Beira can currently only handle vessels of up to 50,000 dwt, in comparison with 180,000 dwt at Nacala. Mozambique’s state owned port and rail utility Portos e Caminhos de Ferro de Moçambique (CFM) calculates that it will lose US$45 million/year as a result of the loss of Vale’s business.

Plans have now been unveiled for a third coal railway and port, this time on a greenfield site. A joint venture of China’s CNCEC, which is a subsidiary of China Machinery Engineering Corporation, and Portugal’s Mota-Engil Engenharia e Construção are to build the line from Moatize to a new port at Macuse, near the mouth of the River Zambezi. It will be operated by Thai Mozambique Logistics. The 500km line will offer the shortest route to the coast, although a 125km extension from Moatize to Chitima, still in Tete, has been agreed to give access to Chitima’s undeveloped coal and iron ore reserves.

According to the Ministry of Transport and Communications, construction work is due to begin by the end of this year, with the first coal carried in 2021 but the project has already been delayed several times because of low international coal prices, so this timetable cannot be taken for granted.

In mid-march, coal was being shipped out of the biggest African coal terminal, Richards Bay Coal Terminal (RBCT) in South Africa, at a free on board price of US$75.95 per tonne, which is in line with prices over the past three years but low by historic standards. The price recovery of the first half of 2017 seems to have faded away.

Too many lines?

Most governments and companies like to give the impression that their decisions are based on long term plans rather than short term needs, but one big question stands out from Mozambique’s rail strategy – why are three lines being developed from Tete Province to the coast?

Officials have explained that the Macuse line is needed to give extra capacity but there is no reason why all of Mozambique’s coal exports could not be moved along a single line, or at most two railways. The Macuse railway will initially be expected to carry up to 30 million tons/year but with the port designed to ship 100 million tons/year, the line would be expected to carry the same volume.

RBCT handled a record 76.47 million tons last year and has a handling capacity 91 million tons/year, yet almost all of its coal is brought in on a single line, from Mpumalanga. Rail utility Transnet Freight Rail (TFR) even hopes to boost its coal carrying capacity to 132 million tons/year. The government of Mozambique has ambitions to boost its own coal exports to 100 million tons/year, which would place it among the six biggest exporters in the world, but this should not require the construction of three lines.

Transit coal

While railways in the northern half of Mozambique are designed to export domestic coal, the south of the country focuses on exporting foreign coal. Maputo’s Matola Coal Terminal, which is operated by South African logistics firm Grindrod, handled a record 5.3 million tons of coal last year, with capacity expected to be ramped up over the next decade.

The coal is brought by road and rail from the heart of South Africa’s coal mining industry in Mpumalanga Province but as some Mpumalanga mines become exhausted, the South African government hopes to replace their production capacity with new mines in the Waterberg Basin in Limpopo Province. TFR is developing a new coal line from the Waterberg to transport coal to RBCT and also Matola.

Botswana is in much the same position as Mozambique with regard to coal exports. It too needs an export corridor but also lacks the support of a company like Vale to drive development. The government of Botswana is confident that it, Mozambique and South Africa could each export 100 million tons/year if it can secure export capacity.

There are three main options: a new railway to the Port of Walvis Bay in Namibia; upgrading its existing line to South Africa, possibly in conjunction with the Waterberg railway, to give access to RBCT and possibly also Matola; or building a new railway to a proposed new port at Techobanine in southern Mozambique. It is likely that a new line to either Techobanine or Walvis Bay would have been built over the past three years had it not been for the collapse in coal prices.

Moving beyond coal

Most existing railway lines on the African continent were built during the colonial era with one aim in mind – transporting raw commodities as quickly as possible to the coast and then to factories in other parts of the world. Relatively little attention was paid to encouraging trade within individual colonies, let alone between them.

This pattern survives today but a second wave of railway construction is now underway that should be better aligned to African economic needs. New standard gauge railways are already being built from the East African ports of Mombasa and Dar es Salaam to the landlocked states around the Great Lakes.

Mozambique could be a key player in this second rail revolution. Its new rail projects may be designed to export raw materials, principally coal, but they can also be used to support broader cross-border trade. The coal lines from South Africa and Botswana could be utilised to handle non-coal trade. At the same time, the coal lines in the northern half of Mozambique can be extended to the landlocked states to the west.

The Nacala line already passes through Malawi on its way from Tete to the Port of Nacala and so connects with Malawian railways. Aside from the Sena line, which runs from Tete to the Port of Beira, another colonial-era railway runs to Beira from Zimbabwe, Zambia and Democratic Republic of Congo. It is operational into Zimbabwe but needs massive upgrading.

All of these projects offer the prospect of much greater trade within Southern Africa. According to the United Nations Economic Commission for Africa, intra-African trade accounted for just 13% of total African trade by value in 2017. This compares with 52.3% in Asia and a massive 68.5% in Europe. More than in most African countries, Mozambique also suffers from too little internal trade.

Maputo has sought investment for a new north-south railway that would link together all of the other lines. A pre-feasibility study is underway and two potential foreign developers have been selected by the government, although their identities have not yet been revealed. The project would support wider economic development and strengthen national cohesion but there seems little chance that it will actually be built for the foreseeable future. Without coal revenues to underpin it, the $20 billion project price tag makes it an unlikely option for investors.