Mozambique, which gained independence from Portugal in 1975, is home to a culturally diverse population of 29 million people. Before the Portuguese arrival in the sixteenth century, the region was an important trading centre for slaves, gold and ivory for Arabs and Persians, centred on the Island of Mozambique, which lies off northern Mozambique’s current borders. The country got its name from its first known ruler, a Muslim Arab emir named Mussa ibn Bique. The Portuguese started referring to the region as the “Lands of Mussa ibn Bique” and from there the name was simplified to Mozambique.

The sixteen years of civil war post-independence left various scars. However, improvements in the poverty level of the population has been observed over the past 25 years. Mozambique has nearly halved the share of its population consuming below a basic needs poverty line. Although the country remains poor, with 49.2% of the population living in poverty, Mozambique is now approaching the living standard levels of other low income African countries, like Tanzania.

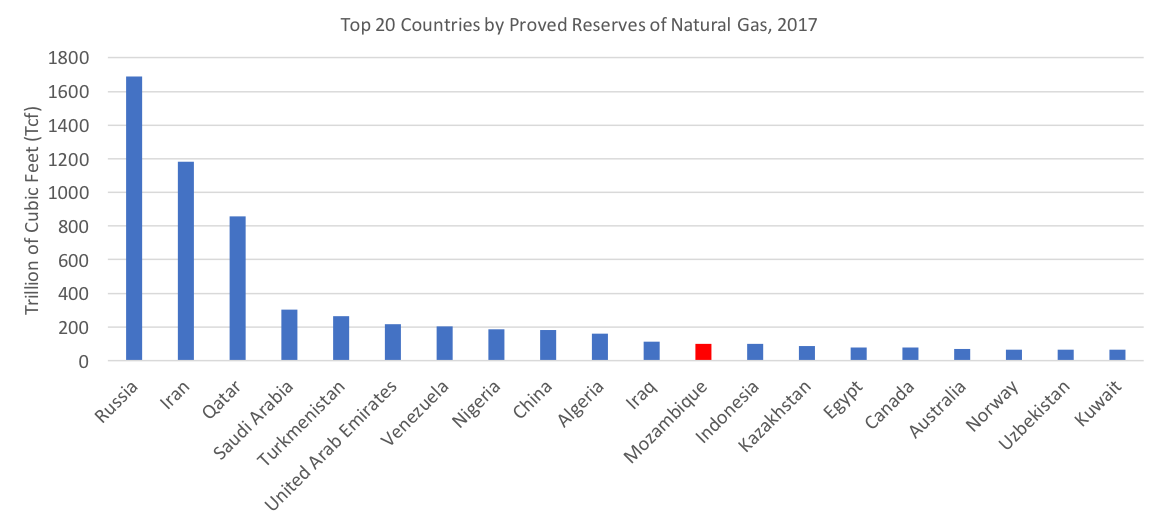

The discovery of immense natural gas reserves one decade ago creates hope that the economic situation and, consequently, living standards of the population will improve dramatically. With proven reserves of 100 trillion cubic feet, Mozambique ranks 12th among the countries with the largest natural gas proven reserves, according to the U.S. Energy Information Administration EIA. Mozambique’s economy is ticking on the royalties and the range of direct and indirect businesses and jobs expected to be created once these reserves start producing.

Top 20 Countries by Proved Reserves of Natural Gas, 2017

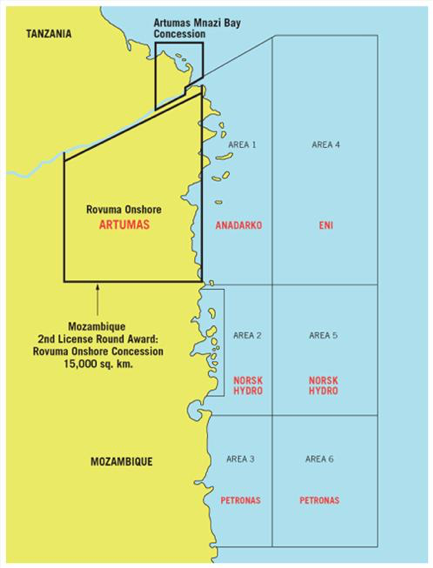

Most of the natural gas discoveries were found in the Rovuma Basin, offshore Cabo Delgado state, northeast of Mozambique, during 5 years of exploration and appraisal activities. The Rovuma Basin is located close to the border between Tanzania and Mozambique, at the Rovuma Delta.

The offshore regions that are receiving most of the attention and where plans for development are ongoing, are Areas 1 and 4, controlled respectively by oil and gas giants Anadarko and Eni.

Area 1 hosts the Prosperidade and Golfinho/Atum complexes, which further host several deepwater discoveries, including Windjammer, Barquentine, Lagosta, Camarao, Golfinho, Orca, and Atum, at an average water depth of 1,600m. Area 4 is where the Coral field is located, at water depths ranging between 1,500m and 2,300m, and situated 241.4km northeast of Pemba, capital of Cabo Delgado province.

In December 2012, Anadarko reached a joint agreement with Eni to establish the foundational principles for the coordinated development of the common natural gas reservoirs spanning both offshore Areas 1 and 4.

Additionally, multiple Front-End Engineering and Design (FEED) contracts were awarded for both onshore liquefied natural gas (LNG) construction and offshore installation.

A total of 60 production wells are proposed to be drilled at Offshore Areas 1 and 4 during the initial phases, which can increase to 120 wells in subsequent stages of the project. The wells will be drilled using drill ships. The output from the gas fields in Area 1 will be conveyed to the onshore LNG plant to be built on the Afungi peninsula in Cabo Delgado province.

The natural gas will be transported from the offshore platform to the onshore processing facility through a 45km-long subsea pipeline. Once the gas reaches the LNG plant, it is cooled down to -162oC (-260oF) and transformed into liquid in order to be exported to other countries through cryogenic vessel tanks or liquefied natural gas (LNG) tankers.

The project aims at initially supplying approximately 100 million cubic feet of natural gas a day (MMcfd) to the onshore LNG facility, which will primarily be equipped with two LNG trains with processing capacity of 6.0 million tons per year (mtpa) each. It will also include two 180,000m³ LNG storage tanks, condensate storage facilities, a multi-berth marine jetty, and ancillary utilities and infrastructure. The LNG processing plant gets the name “LNG train” due to its several parallel units arranged in a sequential manner.

Other onshore infrastructure will include an airfield, power generation facilities (gas turbines), waste disposal facilities and water and wastewater treatment facilities.

Area 4, which lies too far from the coast to economically send gas ashore through pipelines, will have a floating LNG (FLNG) plant with a capacity of 3.4 million tons of LNG per year (mtpa). A FLNG has equivalent processing capabilities as onshore LNG facilities. The difference is that the former is built on top of an offshore platform.

The construction of this engineering feat will take place in South Korea. The Coral South FLNG project in Area 4 received a final investment decision (FID) in June 2017, with an investment of US$ 8 billion. Around 60% of the cost of the FLNG facility will come from project finance, the first instance of such an arrangement for a liquefaction floater, according to Eni. Fifteen international banks have subscribed, backed by five export credit agencies. South African lender Standard Bank and its 20% shareholder, the Industrial and Commercial Bank of China (ICBC), say they are the largest lenders in Eni’s Coral South FLNG.

| Area 1 | Working Interest | Area 4 | Working Interest |

| Anadarko (Operator) | 26.5% | Eni East Africa (Operator) | 70.0% |

| Empresa Nacional de Hidrocarbonetos | 15% | Empresa Nacional de Hidrocarbonetos | 10.0% |

| Mitsui & Co | 20.0% | Kogas | 10.0% |

| ONGC Videsh | 16.0% | Galp Energia | 10.0% |

| Bharat | 10.0% | ||

| PTT Exploration & Production | 8.5% | ||

| Oil India | 4.0% |

Table 1 – Working Interest in the Offshore Areas 1 and 4

| Fact Sheet | Area 1 | Area 4 |

| Operator | Anadarko | Eni |

| Water depth | 1,600m | 1,500m to 2,300m |

| Gas fields | Prosperidade and Golfinho/Atum complexes | Mamba complex; Coral South field |

| Recoverable gas reserve | 75 Tcf | 16 Tcf |

| Estimated production capacity | 12.88 mtpa LNG with potential to upgrade up to 50.0 mtpa | 3.3 mtpa LNG |

| Final Investment Decision (FID) date | Still pending. Anadarko needs to secure 8.5 mtpa in LNG contracts to trigger the FID | June 2017 |

| Buyers |

|

BP will buy 100% of the produced LNG over the first 20 years |

| First gas to be produced | Pending FID | Mid 2022 |

Table 2 – Fact Sheet Mozambique’s Natural Gas Developments

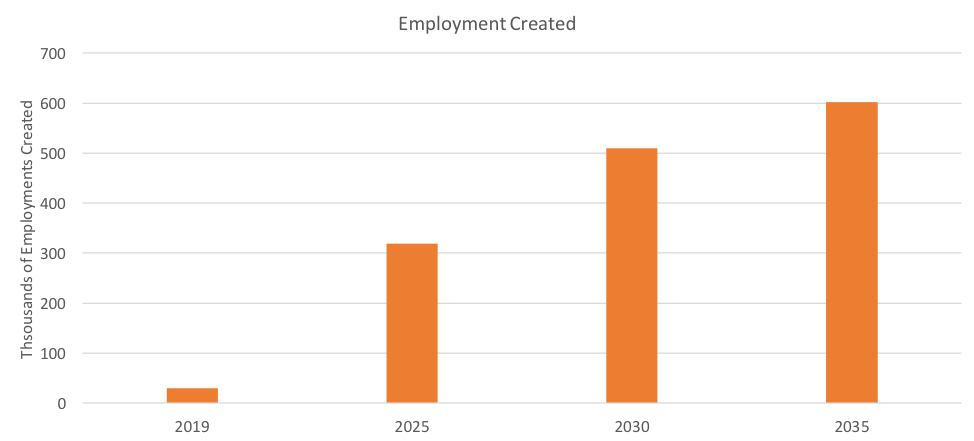

The development of the onshore infrastructure will generate a large number of jobs to the local people, both directly and through supporting businesses that will inevitably blossom as a result of the additional people moving to the region and economic uplifting brought by the natural gas sales. Megaprojects such as this create an unmatched opportunity for the local population to develop technical and vocational skills, boosting the country to become competitive in the global arena.

A macroeconomic study conducted by South African Standard Bank in 2014 examined the impact of the development of the Area 1 project with 6 LNG trains on the Mozambican economy. The study found that, if the first gas indeed starts being produced by 2022, Mozambique has the potential to add 600,000 jobs to its economy by 2035. This number can go even higher when considering the employment opportunities that will be created by Coral South (Area 4), which has already received the go-ahead from all parties involved.

Employment created in Area 1 starts producing gas by 2022

The study also points out that over 70% of the jobs that will be created by the Mozambique LNG projects will be of an un-skilled or semi-skilled nature. The migration of skilled labour to the region will also create prospects for skills transfer to occur among local workers, thus increasing the competency of the local labour force.

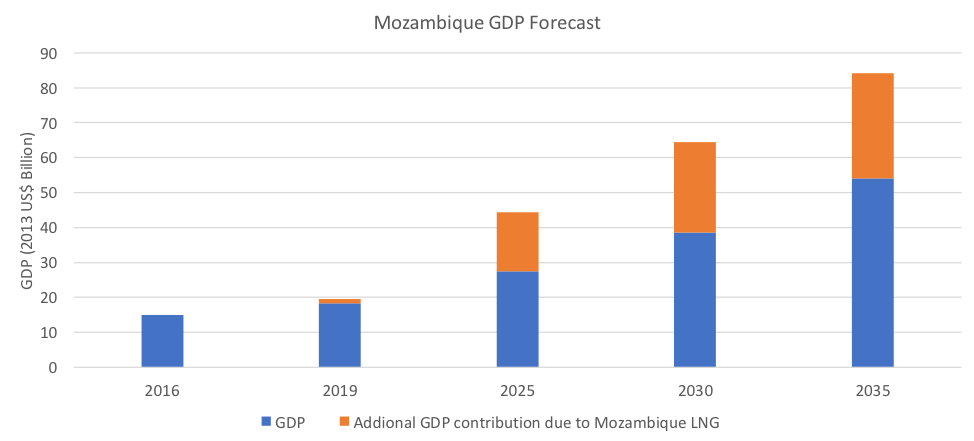

The impact of natural gas exploration in Mozambique will also significantly affect the country’s GDP. The economic contribution due to the development of just the Area 1 project is expected to account for 56% of Mozambique’s GDP by 2035. Consequently, the GDP per capita of the population will also dramatically grow. Although GDP per capita can be distorted by high inequality in societies, it remains a sound indicator of the average income per person in an economy. Mozambique’s real GDP per capita in 2016 was US$ 382. With the fruits of the development of Area 1, GDP per capita income is expected to grow eleven-fold, reaching US$ 4,450 by 2035.

Mozambique’s GDP Forecast and gains from Natural Gas exploitation

Another channel through which the Mozambican economy will benefit from the investments in natural gas exploration, is additional tax revenue, both income tax, from the new jobs created, and corporate tax, from Anadarko’s and Eni’s operations. Furthermore, the likely increase in household consumption expenditure due to greater household income, implies additional revenue from indirect taxes, including value added tax (VAT).

Mozambique occupies a privileged geographic location in relation to the trading routes for LNG, being able to reach customers in Asia-Pacific markets and to tap into the growing demand for energy in India and China. However, to really enjoy the spoils LNG sales will generate and to transform the quality of life of its population, Mozambique will need to work on improving its institutions, curbing corruption and enforcing the rule of law, besides building infrastructure that currently is inefficient or non-existent. Today, the country ranks at 138th in “Ease of Doing Business”, out of 190 countries, and scores at 153th out of 180 countries in the “Corruption Perception Index.” There is, therefore, a lot of work to be done and a lot to improve.