Mozambique is awaiting an answer from China regarding a debt relief request, on a total debt load worth 1.3 billion, the African country´s Economy and Finance Minister, Adriano Maleiane, has revealed.

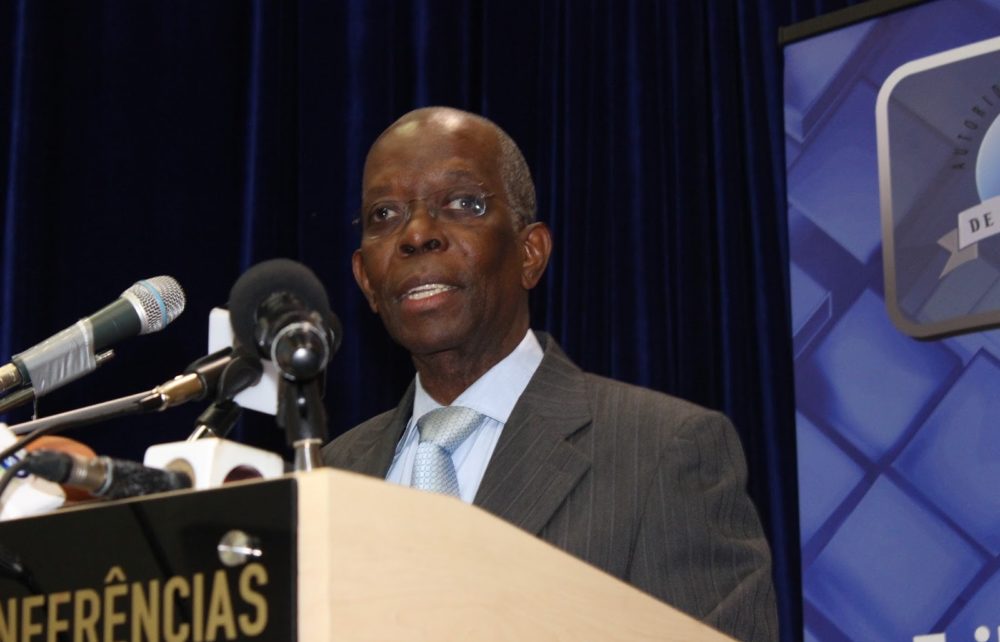

Speaking on Wednesday in a World Bank annual meetings videoconference, Maleiane said Mozambique has “two types of loans with China”, bilateral debt to the Government and another to the banking system, in a total of USD 1.3 billion.

Relief was requested from the remaining bilateral creditors, so that the country can respond to the Covid-19 emergency, and the Economy and Finance Ministry has “also written” to the Chinese authorities and awaits reply.

At the videoconference, Odile Renaud-Basso, the secretary general of the Paris Club, a bilateral creditors group, said Mozambique’s process for adhering to external debt relief is under conclusion.

In a report published this month, Mozambique NGO Center for Public Integrity (CIP) estimated at USD 2.02 billion the stock of debt to China at the end of 2019 and urged the Government to “clarify how it will repay this debt and present in detail the projects that were financed with the loans”.

According to CIP, the increase of debt with China worsened after 2016: in 2010, it only totalled USD 45 million, in 2011 alone it grew by 415.8%, and in December 2018, it peaked at USD 2.15 billion; currently, it is estimated to be 20.2% of Mozambique’s total external debt and 13.2% of 2019 GDP.

“The 7 years of grace commonly offered by the Chinese government for its loans with Mozambique are coming to an end”, CIP adds, and “debt service to China has the potential of creating a large diversion of funds needed for social sectors, especially in the current context of the COVID-19 pandemic”.

According to CIP, the coming months “will be very difficult for public finances in Mozambique”, with the Metical depreciating (already 16.2% from January to 30 September 2020), translating into increases in the debt service that the Government has to incorporate into its budget, so as not to fall into default.

“To protect the social sectors from a diversion of funds for payments on a debt tainted by a lack of transparency, the Government should consider the need to pressure China to reschedule that debt, within the context of debt forgiveness offered recently by the G-20 Group”, CIP adds.

This week, China’s foreign ministry said Exim Bank of China has signed debt suspension agreements with 11 African countries as Beijing committed to fully taking part in the Group of 20 Debt Service Suspension Initiative (DSSI).

China is “actively responding to African concerns in accordance with the consensus reached by Chinese and African leaders and the G20 DSSI”, foreign ministry spokesman Zhao Lijian said on Monday.

Zhao said China would also waive interest-free loans due to mature by the end of 2020 for 15 African countries and would continue to push the international community, especially the G20, to further extend the duration of debt suspension.

China did not reveal which countries had benefited from Beijing’s debt relief or whose interest-free loans had been waived. But several countries, such as Zambia, Angola, Ethiopia, the Republic of Congo (Brazzaville), Djibouti and Kenya, are reportedly negotiating to have their Chinese loans restructured.

The Group of 20 wealthy nations, including Japan, the United States and Britain, have accused China of not fully taking part in the DSSI, and therefore failing to help African countries cut their debt burden.

The G20 countries launched the DSSI in April. It offered a debt payment moratorium between May 1 and end of the year for 73 low-income countries – mostly in Africa and some in Asia – hit by the coronavirus pandemic. The initiative has freed up US$5 billion from the DSSI to fund social, health and economic measures to respond to the pandemic.